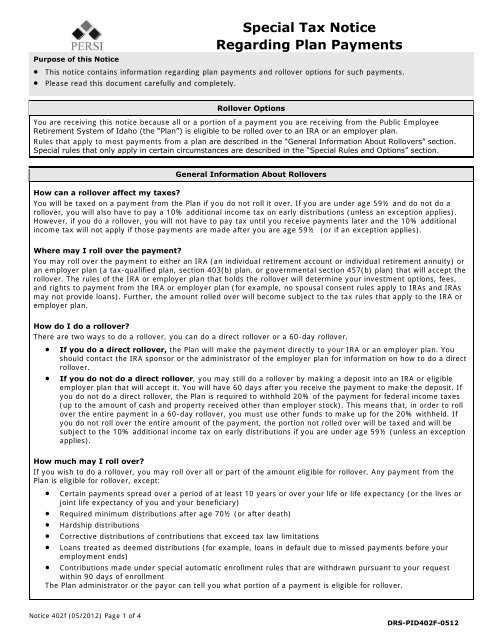

special tax notice regarding plan payments

However if you receive the payment before age 59-12 you. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and contains.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and.

. The additional 10 tax generally does not apply to 1 payments that are paid after you separate from service with your employer during or after the year you reach age 55 2 payments that. Are under age 59½ and do not do a rollover you will also have to pay a 10 additional income tax on early distributions generally distributions made before age 59½ unless an exception. Stances payments from a 401qualified retirement plan may be eligible for special tax rules that could reduce the tax you owe.

Payments from OPM may be eligible rollover distributions This means that they can be rolled over to a traditional IRA a Roth IRA or to an eligible employer plan that accepts. If you are under age 59½ you will have to pay the 10 additional income tax on early distributions for any payment from the Plan including amounts withheld for income tax. Applies to the part of the distribution that you must include in income and is in addition to the regular income tax on the payment not rolled over.

If you choose to have your Plan benefits PAID TO YOU You will receive only 80 of the payment because the Plan administrator is required to withhold 20 of the payment and send it to. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS1 This notice explains how you can continue to defer federal income tax on your retirement savings in the Plan and contains. However if you receive the payment before age 59-12 you.

This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401. You will be taxed on a payment from the Plan if you do not roll it over. If you have additional questions after reading this notice you can contact your Plan Administrator at 800 803-7377 or 701 328-3900.

If you are under age 59½ and do not do a rollover you will also have to pay a 10 additional income tax on early. Stances payments from a 401qualified retirement plan may be eligible for special tax rules that could reduce the tax you owe. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement plan savings in the Plan and contains.

IRS Model Special Tax Notice Regarding Plan Payments. SUMMARY There are two ways you may be able to. The 10 additional income tax does not.

You may roll over to an employer plan all of a payment that includes after-tax contributions but only through a direct rollover and only if the receiving plan separately accounts for after-tax.

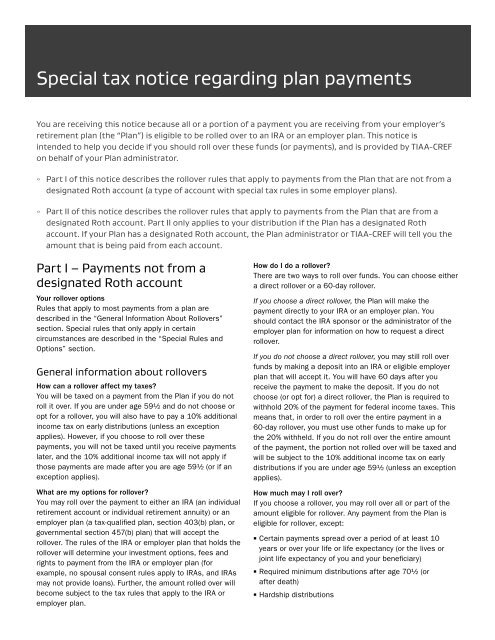

Special Tax Notice Regarding Plan Payments Tiaa Cref

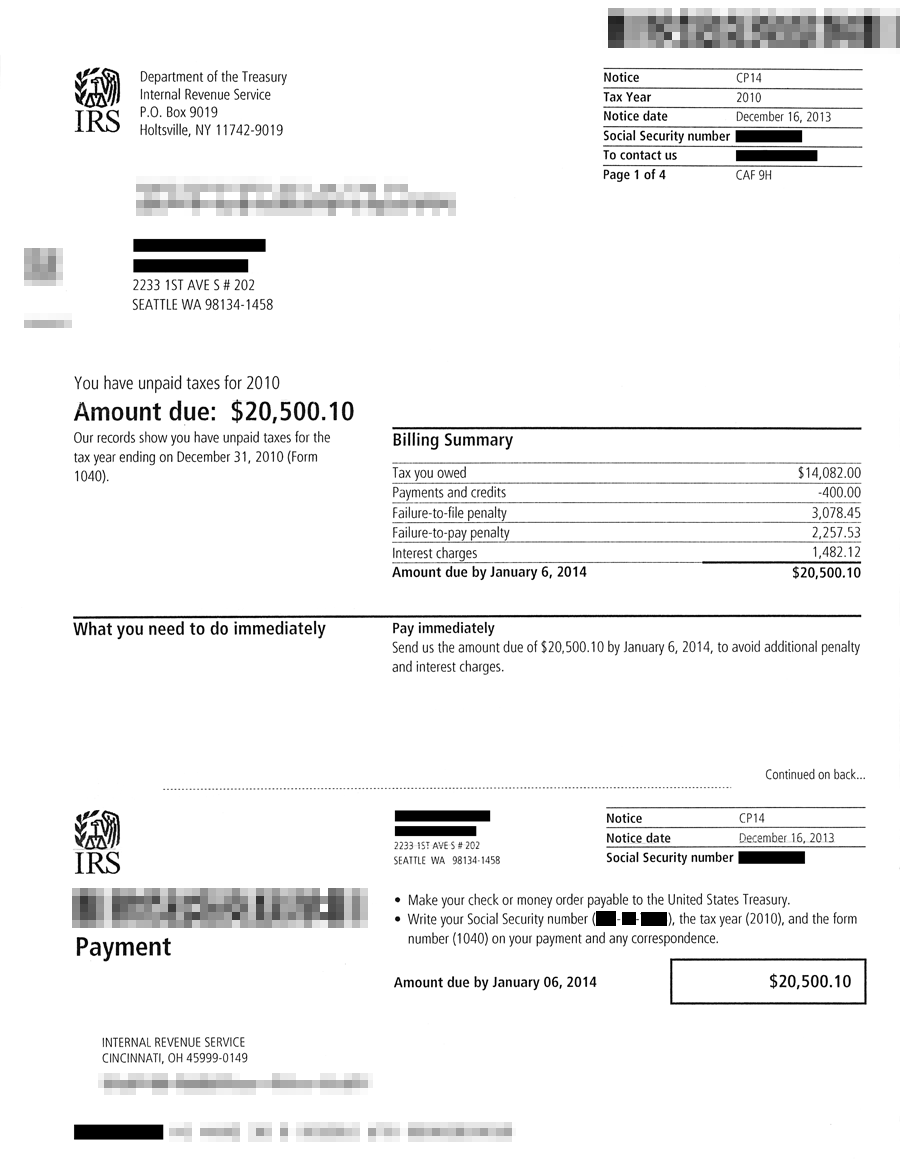

Irs Cp 215 Notice Of Penalty Charge

Notice Cp504b What It Means How To Respond Paladini Law

Tax Letters Washington Tax Services

Irs Notices And Letters Where S My Refund Tax News Information

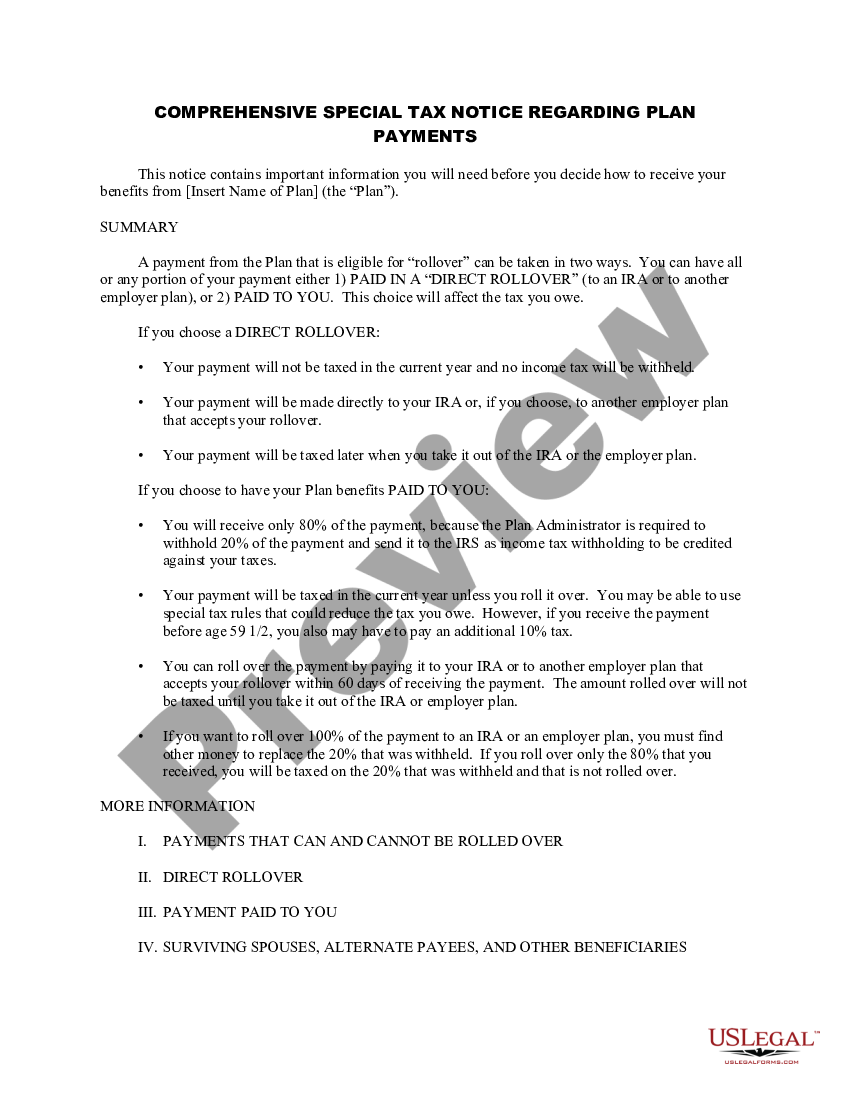

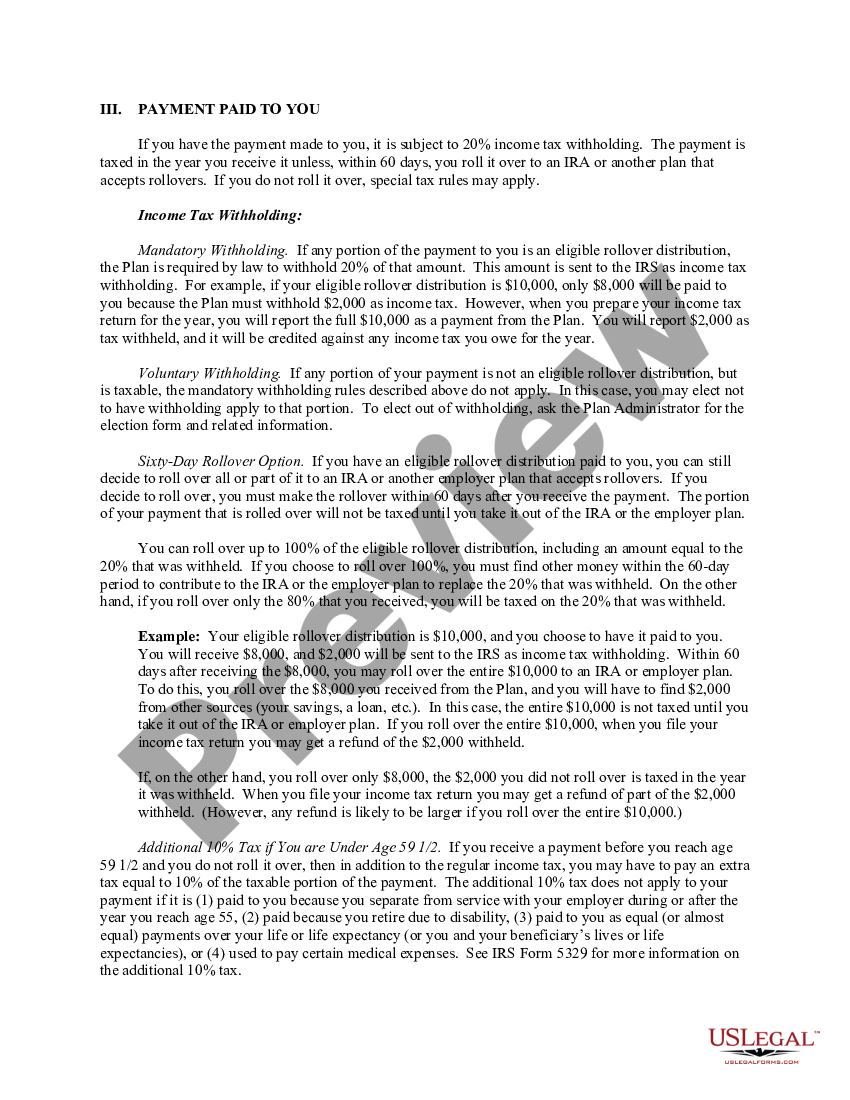

Comprehensive Special Tax Notice Regarding Plan Payments Us Legal Forms

Comprehensive Special Tax Notice Regarding Plan Payments Us Legal Forms

Special Tax Notice Regarding Plan Payments Tiaa Cref

Irs Tax Notices Explained Landmark Tax Group

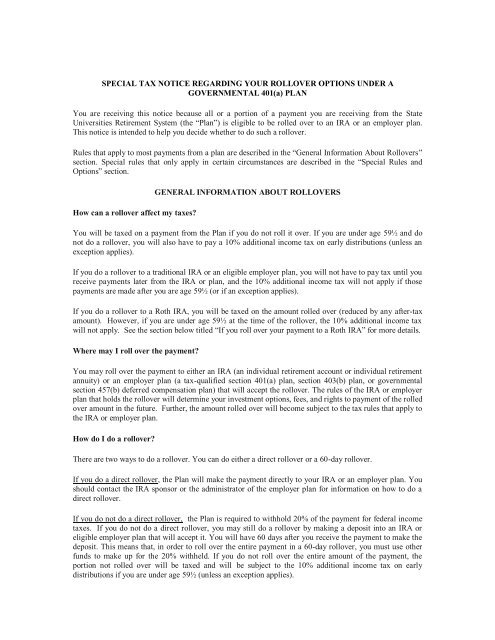

Special Tax Notice Regarding Your Rollover Surs

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

Nyc Government Publication Fact Sheet Special Tax Notice Regarding Plan Payments Id Xg94hs12h Government Publications Portal

Irs Cp 169 Notice Of Missing Return

Comprehensive Special Tax Notice Regarding Plan Payments Us Legal Forms

What Is A Cp05 Letter From The Irs And What Should I Do

Comprehensive Special Tax Notice Regarding Plan Payments Us Legal Forms